Systematic Investment Plans (SIPs) have become a preferred investment strategy for millions of retail investors in India. Offering discipline, consistency, and the advantage of rupee cost averaging, SIPs have been instrumental in helping individuals build long-term wealth. The year 2024 marked a significant milestone for SIP inflows, with monthly contributions steadily climbing to record-breaking figures. Let’s explore the actual month-wise data and understand how SIPs are shaping India’s investment landscape.

SIP Contributions: Month-by-Month Highlights

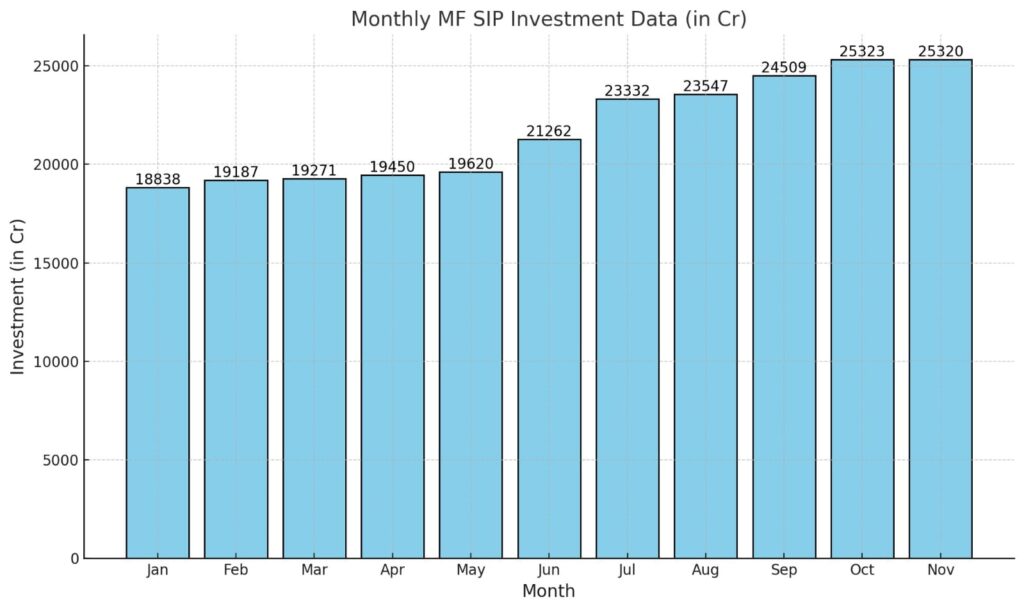

January 2024: A Strong Start

The year began on a high note with SIP contributions totaling ₹18,838 crore. This was attributed to heightened awareness about compounding and tax-saving efforts.

Example: Meena, a 32-year-old architect, began a ₹10,000 monthly SIP in a large-cap equity fund to create a ₹30 lakh corpus for her children’s education over 10 years.

February 2024: Momentum Builds

SIP inflows rose slightly to ₹19,187 crore, showcasing continued investor enthusiasm during the tax-saving season.

March 2024: Record Peaks Before Fiscal Year-End

The fiscal year closed with SIP contributions climbing to ₹19,271 crore. Last-minute tax-saving investments drove the surge, along with increased participation from first-time investors.

Insight: A ₹12,500 SIP in ELSS funds (under Section 80C) can create a ₹40 lakh corpus in 15 years at a 12% annual return.

Mid-Year Adjustments: Stability Amid Market Swings

April 2024: Post-Tax Season Stability

SIP inflows were steady at ₹19,450 crore in April as investors maintained their discipline after the tax-saving season.

May 2024: Gradual Growth

SIP contributions rose to ₹19,620 crore in May, reflecting investor confidence despite market fluctuations.

June 2024: New Investors Join the Bandwagon

After a brief dip in data availability for April and May, contributions surged to ₹21,262 crore in June. This growth was driven by financial advisors encouraging first-time investors to capitalize on market corrections.

Example: Sunil, a college professor, used his annual bonus to start an additional ₹8,000 SIP, boosting his retirement fund.

July 2024: Millennials Drive the Momentum

SIP inflows reached an impressive ₹23,332 crore, reflecting increased participation from younger investors who prioritized financial planning early in their careers.

August 2024: Festive Investments Take Center Stage

With the festive season, contributions rose to ₹23,547 crore. Many investors chose SIPs as a gift for their loved ones, highlighting a growing trend.

Example: Anuj gifted his nephew a ₹2,000 monthly SIP in a mid-cap fund, which could grow to ₹15 lakh in 20 years.

September 2024: Record-Breaking Growth

For the first time, SIP inflows crossed the ₹24,000 crore mark, totaling ₹24,509 crore. Investors leveraged market rallies to maximize long-term gains.

A Grand Finale: October to December 2024

October 2024: Festive Boost Continues

SIP contributions soared to a record ₹25,323 crore, driven by Diwali bonuses and year-end financial planning.

November 2024: Sustained Growth

Maintaining momentum, inflows slightly declined to ₹25,320 crore as retail investors remained disciplined and optimistic about market trends.

December 2024: Data Pending

While December’s final data is yet to be officially released, the upward trend from the preceding months suggests another significant contribution.

Key Takeaways from 2024’s SIP Growth

- Consistency Wins: The steady month-on-month growth in SIP contributions underscores the disciplined approach of retail investors.

- Broader Participation: Millennials and first-time investors played a vital role in sustaining inflows.

- Strategic Planning: Tax-saving opportunities, festive gifting, and market corrections emerged as key drivers of SIP growth.

Why SIPs Are the Ultimate Wealth-Building Tool

Consider this: A monthly SIP of ₹15,000 started in January 2024 with an annual return of 12% could grow to approximately ₹52 lakh by December 2034. In contrast, a recurring deposit yielding 6% would only reach ₹36 lakh. The power of compounding and rupee cost averaging clearly makes SIPs a superior choice for long-term wealth creation.

Conclusion: 2024—A Record-Breaking Year for SIPs

The year 2024 reaffirmed the transformative potential of SIPs in building financial resilience and wealth. With contributions peaking at ₹1.72 lakh crore, SIPs have become a cornerstone of India’s investment journey. Whether you’re a seasoned investor or just starting, SIPs offer a disciplined and rewarding path to achieving your financial goals.

Why wait? Start your SIP today with the guidance of trusted platforms like Munafawaala and take the first step toward financial freedom.