Every parent dreams of providing the best education and opportunities for their children. However, the rising costs of schooling, college, and higher education can put immense financial pressure, especially when these expenses come during your retirement years. Why not plan ahead and make your child’s future stress-free while growing your wealth over time?

A Practical Investment Example

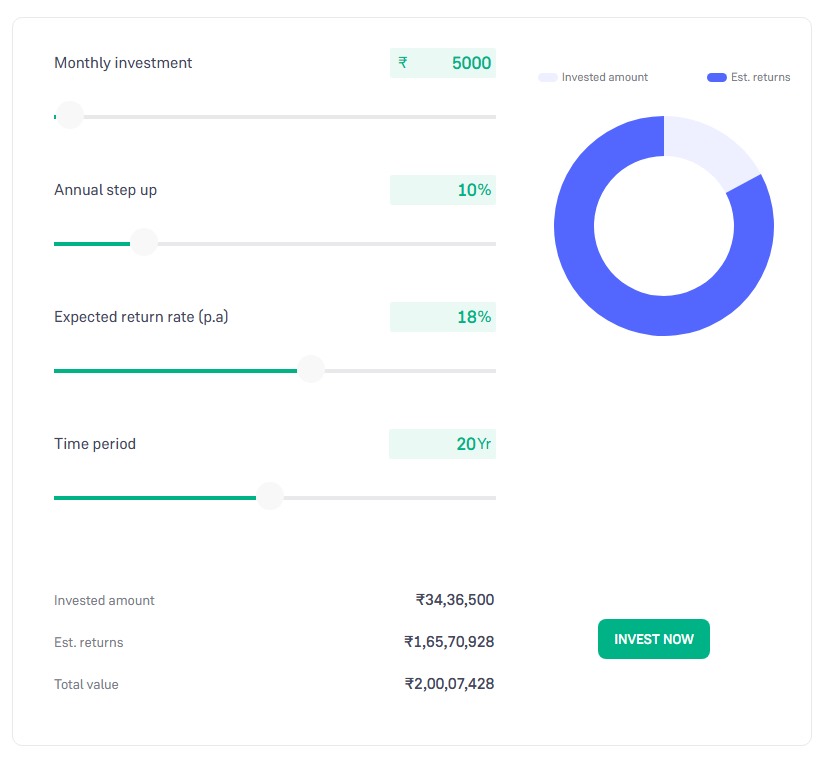

Imagine starting a small investment of ₹5,000 per month when your child is born. As your income grows, you increase this amount by 10% annually. With consistent investing and a return of 18% annually, you could create significant wealth by the time your child turns 20.

Key Highlights:

- Start with just ₹5,000 per month.

- Gradually increase your SIP by 10% every year.

- Grow your investments with an expected return of 18% annually.

- Achieve financial milestones without stress.

Why Plan Early?

- Compounding Power: Early investments grow exponentially due to compounding. The longer you invest, the greater the wealth you accumulate.

- Flexible Withdrawals: With a disciplined investment, you can withdraw from your corpus at crucial stages like schooling, college fees, or higher education without taking loans.

- Avoiding Financial Burden: Starting early allows you to take small, manageable steps, ensuring you don’t face the financial burden during retirement.

Breaking Down the Numbers

Let’s say you consistently follow this plan:

- Monthly SIP: Starts at ₹5,000, increasing by 10% every year.

- Annual ROI: 18%

- Duration: 20 years

How This Helps Your Family

- Peace of Mind: Know that your child’s future is financially secure.

- Reduced Debt: Avoid the stress of taking loans for education or other expenses.

- Focused Goals: With planned investments, you can focus on personal and professional growth without worrying about future expenses.

Final Thoughts

Investing in your child’s future isn’t just about money—it’s about building security, confidence, and peace of mind for your family. Start small, stay consistent, and watch your efforts grow into a significant financial cushion for your loved ones.

💡 Pro Tip: Speak to a financial advisor or mutual fund distributor to select the best SIP plans for your goals. Regularly review and rebalance your portfolio for maximum growth.

Start your journey today! Secure your child’s future with Munafawaala—Your Trusted Investment Partner.